Toyota closed its latest fiscal year with increased profit, even though the outlook announced in the beginning was viewed and reported as an "80 percent drop" in operating income. Automotive economic journalist Naoto Ikeda examines the results to understand what drove them.

In announcing its FY2021 financial results on May 12, Toyota Motor Corporation said it finished the year with increased income before income taxes despite it being a year impacted by various crises.

The outlook announced in the beginning of the fiscal year was for 8 million units in vehicle sales worldwide and 500 billion yen in operating income, but the year-end results were 9.08 million units in vehicle sales and 2.1977 trillion yen in operating income.

How can one understand the gap between the first forecast and the results? How did Toyota get back on track over the year? Automotive economic journalist Naoto Ikeda contributed a commentary to Toyota Times.

On May 12, Toyota Motor Corporation announced its financial results for FY2021 (from April 2020 to March 2021). Since images of the trend laid out by previous quarterly earnings were running through my mind, I was thinking in the lead-up to the announcement that the numbers would naturally be good this time, too. Even so, when I saw them, I burst out in laughter.

Miraculous financial results

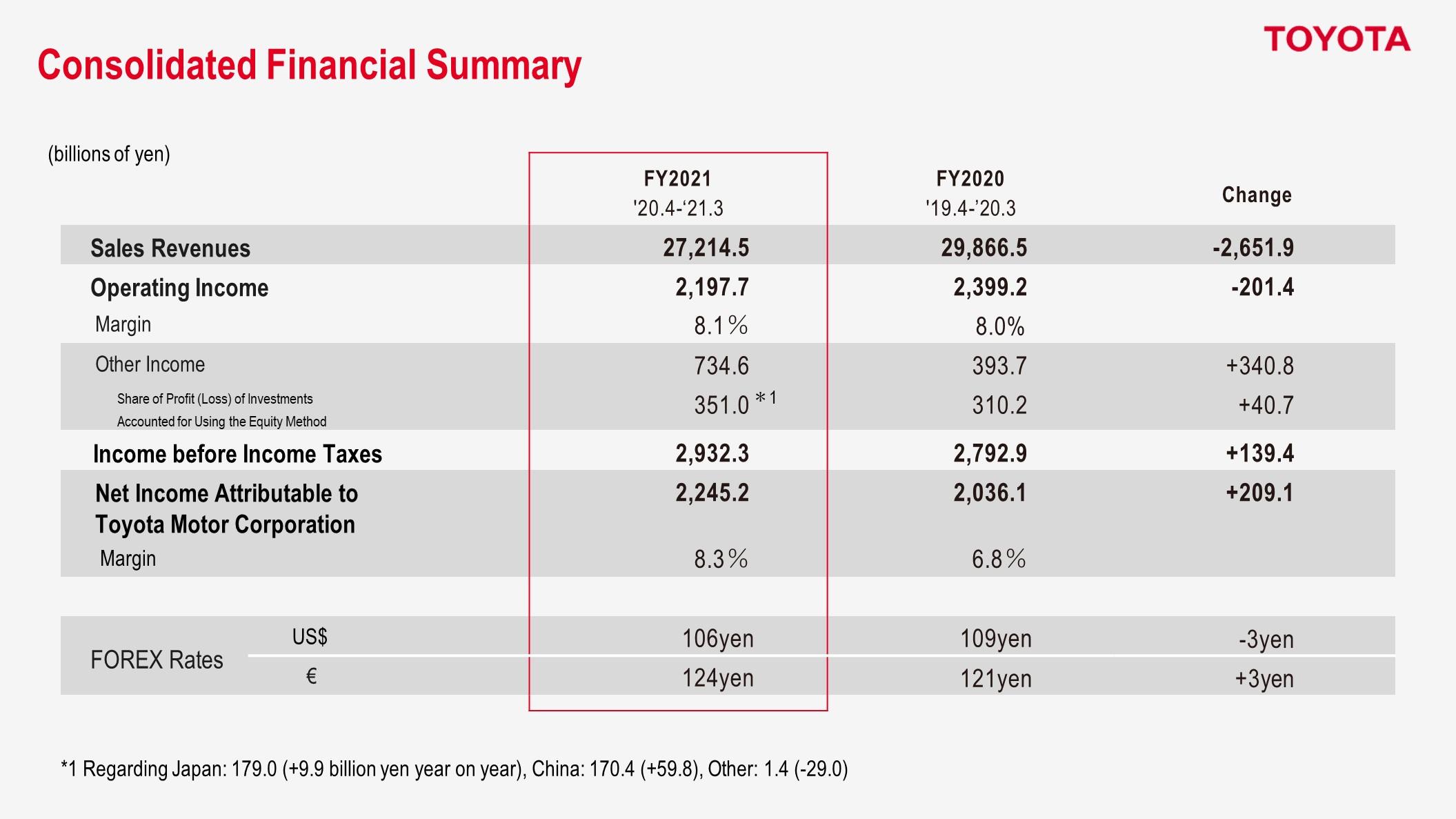

The first thing that caught my eye was sales revenue. Sales decreased by 2.6519 trillion yen, down from 29.8665 trillion yen in the fiscal year ended March 31, 2020, to 27.2145 trillion yen. I had expected a slightly larger drop, but a negative is still a negative, so I still kind of hit my mark. It’s rather common sense that sales would go down in such a fiscal year.

However, income before income taxes increased by 139.4 billion yen from 2.7929 trillion yen to 2.9323 trillion yen. In other words, Toyota’s financial results were one of a decrease in sales and an increase in profits. Said in yet another way, sales went down but profit went up.

To top it off, Toyota’s profit margin increased from 8.0 percent by 0.1 points to 8.1 percent. This is no less than a model result for profitability. There is no other word than “perfect”.

I need to point out that these are the results of a fiscal year directly struck by the COVID-19 pandemic, which has been said to be an unprecedented crisis for humankind. It was the very year in which fears of a global depression loomed and in which people around the world were forced to endure repeated lockdowns. Or, in the case of Japan, people’s movements were restricted by repeated declared states of emergency, economic activity was powerless, and days were spent during which it was almost impossible to eat out or even go out.

Still now, nearly a year and a half after the outbreak of COVID-19, the crisis is ongoing for people around the world, with many lives continuing to be lost as people wait and hope for an unknown way out. Under such circumstances, how can a profit of nearly 3 trillion yen be possible? No matter how many hits you think you can take there is usually a limit. To be blunter, what kind of out-of-this-world catastrophe would it take to knock the heck out of Toyota’s financial results?

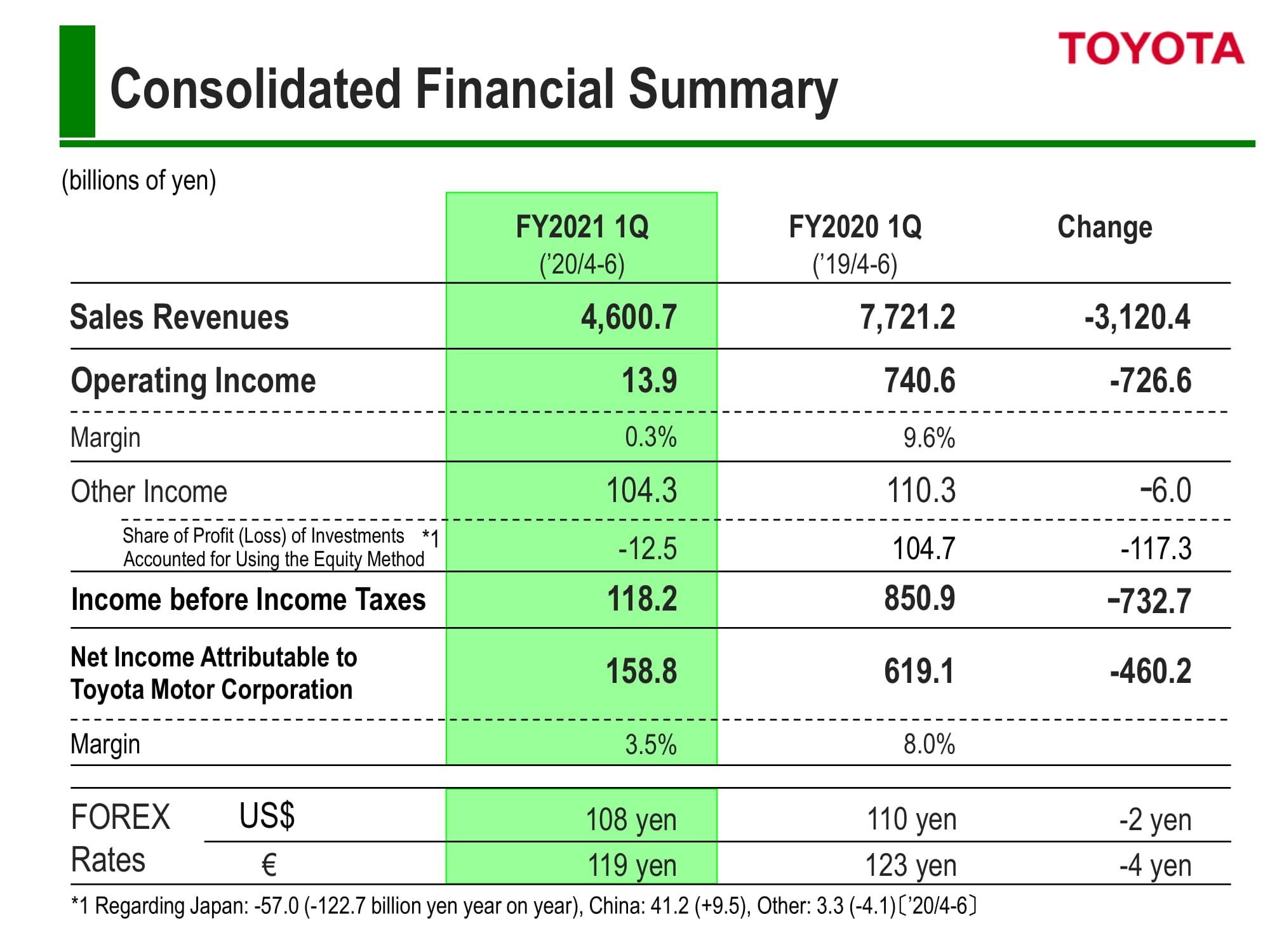

At the beginning of FY2021, while trapped in my workroom due to the first declared state of emergency, I had imagined that the results for automobile manufacturers throughout the year would be as follows: first quarter—catastrophic damage; second quarter—redder than red; third quarter—finally signs of narrowing deficits; and fourth quarter—a struggle to make up for first-half losses with second-half gains, even if manufacturers were able to unexpectedly put up a good fight around the turning point of getting back into the black for the quarter.

It’s scary to think about it, but Toyota’s results for the full year were achieved even though it was as if the three months of the first quarter hadn’t even existed. As mighty as Toyota might be, its operating income for the first quarter was only 13.9 billion yen. In other words, at that pace, its income before income taxes would have been limited to only 55.6 billion yen for the whole year.

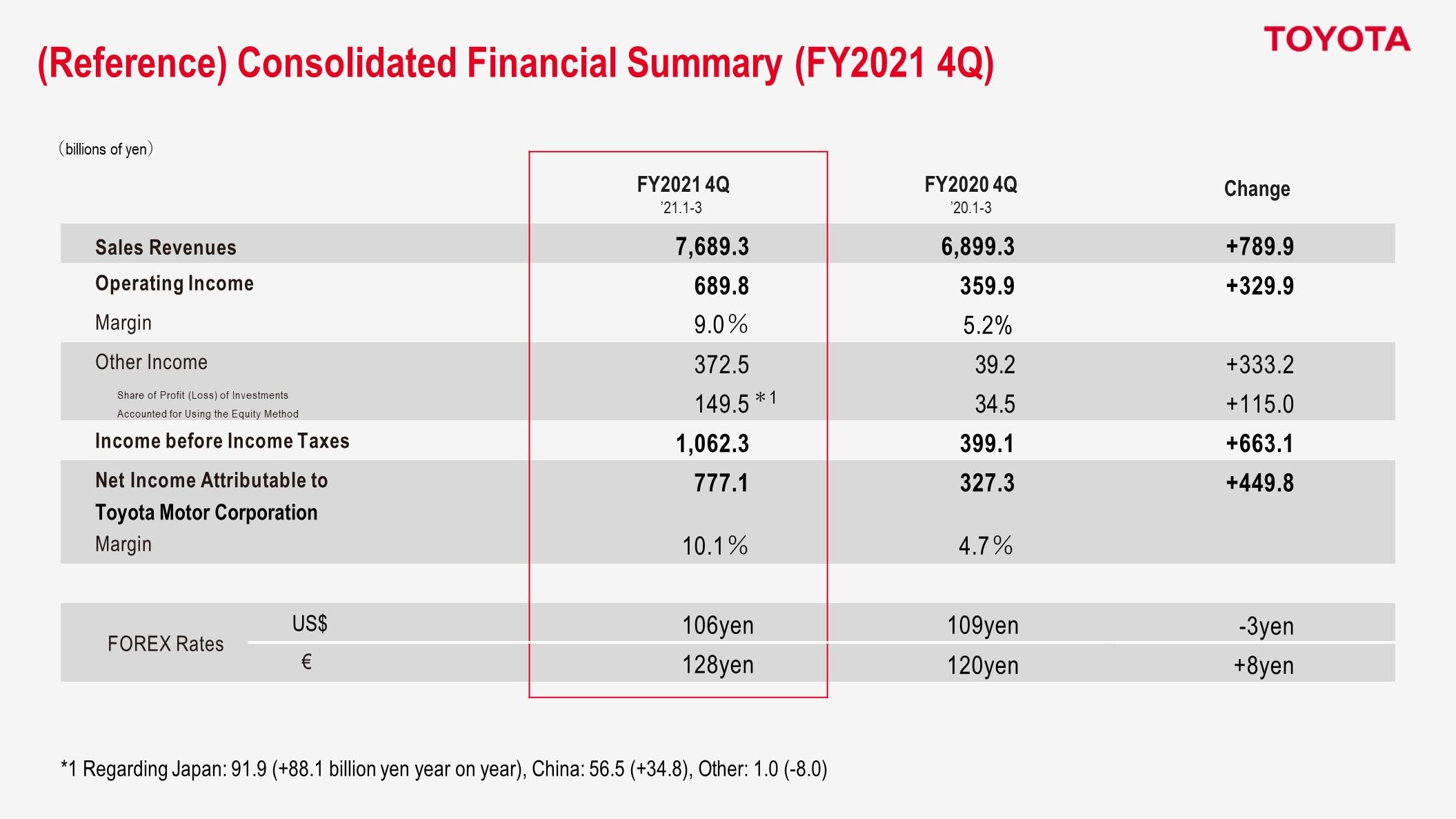

However, the reality was that Toyota landed at 2.9323 trillion yen. Going the other way, if you multiply Toyota’s fourth-quarter results by four, its whole-year profit would be an astounding 4.2492 trillion yen. I admit that such is a rather rough way of reasoning, but you can’t say that it won’t happen the next time around. My amazement leaves me almost speechless. Is such a preposterous V-shaped recovery truly even possible? I decided to pull myself together and have a look at the numbers.

Understanding the factors that increase or decrease consolidated operating income

Let’s start with the factors that increase or decrease consolidated operating income. The gray column on the left shows Toyota’s operating income for FY2020 (from April 2019 to March 2020). The red column on the right is that of FY2021. And the height difference between the two columns is illustrated by way of the items shown between them.

First, from the left, are the effects of foreign exchange rates. As is also the case in times of conflict or economic slowdown, the yen is always purchased when there are signs of turmoil in the global economy. This is because the yen, which is the world’s most stable currency, is very popular during phases of risk.

For Japanese automakers, fears brought on by a global epidemic not only have to do with disrupted supply chains and hurt financial standings of potential customers but also inevitable bleeding due to a strong yen. This explains the negative 255 billion yen.

Next is Toyota's legendary sword of cost reduction efforts, which brought back 150 billion yen. As I mentioned earlier, supply chains have been disrupted due to lockdowns and other factors. Also, costs have been increasing, such as due to the need to acquire substitute parts. Toyota’s ability to squeeze out a positive 150 billion yen under such circumstances is awe-inspiring.

The third is the effects of marketing activities, which, as one might expect, experienced a drop. Sales fell from 8.955 million units to 7.646 million units, hitting 85.4 percent of what they were a year earlier. This number is difficult to comment on, but if you look at the new models that debuted in the past year, their prices are unmistakably higher than the old models.

So, my genuine view is that per-unit profit has worked to dilute a simple drop in the number of units sold. In other words, the wounds in this item were only skin deep because Toyota was able to successfully release new products with high product appeal, which I will touch upon later.

There is one more point here. If you look at the details of each item, you will see that the positive generated in financial services is quite large. Especially in North America, the ratio of private customers using leases is high. Leased vehicles are reclaimed on the contract expiration date. If the used-car market price at that time exceeds the residual value predicted at the time of leasing, the price difference increases profit.

An increase in the sales ratio of currently popular SUVs, for which used prices remain high, naturally increases this trade-in profit margin. So not only when selling a car, but also in terms of the price difference at the time of reclamation, having popular SUVs with high unit prices is profitable. This means that hit TNGA-generation models such as the RAV4, Highlander, and Harrier (named “Venza” in North America) support the positive results of Toyota’s financial services.

The fourth is the increase or decrease in expenses and expense reduction efforts, which is a positive of 70 billion yen. Looking at the items, the impact of expense reduction efforts is large. Expenses likely decreased due to the advance of work style reforms that restrained movement, such as remote work due to the impact of COVID-19.

Based on Toyota’s long-cherished “genchi genbutsu principle”, it is important to go to where the action takes place and make a judgment with your own eyes if something happens. That is not expected to change, in principle. On the other hand, in cases in which there is a way to get something done without going to the actual place, it seems that it has become possible to go straight for choosing to reduce cost.

In Japanese business practice, from the aspect of being courteous, paying a direct visit has been seen as a virtue. But such social common sense has undergone review in the new normal. As such, the cultural trend toward no longer viewing it to be rude not to discuss things face-to-face can also be seen as having contributed to the positive results in expense reduction efforts.

Well, from the financial statements, this is all that can be seen about how Toyota fought in FY2021. However, as an automotive economic journalist, because I also conduct interviews on the car side daily, I would like to dive deeper into what lies at the foundation of Toyota’s fighting methods explained so far.

Toyota’s constant battlefield

Toyota’s financial results are characterized by a balance between offense and defense. It’s a very conceptual way of saying it, but, for management, offense is inevitably hit and miss. Just because you make something good doesn’t mean that it will always sell. And sometimes you have something that’s a hit because it has caught on to a trend, leaving you wondering: “Why is this such a hot seller?” Such is a world dominated by trends, including images and social atmosphere.

But defense is different. Reduced expenses always tell the truth. Of course, cost reduction that trades off quality and safety is out of the question. But if there is a balance between improving quality and safety and reducing costs at the same time, it’s always a sure bet. It is said that a journey of a thousand miles starts with but a single step, but that step never goes away.

When it comes to Toyota, there is, of course, kaizen (continuous improvement). The thinking that “that kaizen involves cost reduction” is the foundation of the Toyota Production System. I believe that there are many truths in that.

Intrinsically, kaizen is offense, and cost reduction is defense. Toyota has cherished cost improvements that are easy to quantify. I think that there have been times when kaizen served as a means of cost reduction.

That said, Toyota seems to have redefined kaizen using new language over the past decade. I’m referring to the words: “ever-better cars”. I mean, by swapping out a few words, we get: “make ever-better cars along with improving costs”.

And TNGA was adopted as a way to give form to ever-better cars. As a result, for Toyota cars that have undergone full redesigns since 2015, the way they ride is unquestionably better. Moreover, the way they ride just keeps on getting better every time a new model is launched. Due to endless kaizen, ever-better cars will continue to evolve into “ever-better-and-better cars”. I think this is probably what most people would feel if they test-drove a new model every time one came out.

In explaining the financial statements earlier, I mentioned the purchase price of used cars. When we buy used cars, to be frank, we often draw the line by saying: “I don’t want anything older than this generation.” And if there is a breaking point in value, there is also a breaking point in price, and it ends up that the cars that attract us have a higher price. To make more of such attractive cars, Toyota has been refining the driving performance of its cars for the past 10 years.

For example, the method of careful handmade production had been a world that availed itself only to the rich. However, through its GR Factory initiative, which fuses a handmade approach with efficient assembly, and through the resulting GR Yaris, Toyota showed that it could lower the price of a car of high-precision assembly, which had been previously unattainable for common people no matter how hard they tried, by an order of magnitude.

The effort is not limited to the GR Factory. The above-mentioned “because Toyota was able to successfully release new products with high product appeal” is precisely the result of TNGA. And TNGA, itself, was the result of continuing from before efforts to lessen vulnerability in Toyota’s business structure, which had been ailing to the core after being hit by a shocking fall into the red due to the global financial crisis.

As such, Toyota has always pursued improvements in everything they do while being on a constant battlefield. Toyota has continued to fight the global financial crisis ever since the crisis struck with the determination that even if the same kind of crisis should happen again, the company would never be trapped in the same rut.

Its financial results of a year with the COVID-19 pandemic proved that the company’s efforts in making attractive ever-better cars and lowering the break-even point by reducing costs have transformed Toyota’s corporate structure into one that is resistant to crises.

<Related Links>