How does Toyota's Purchasing Group engage with suppliers? How many are there, and what efforts are being made to improve relationships? We examine the principles passed down since the company's founding.

“The best possible products at the lowest possible cost, in the most timely manner, on a stable long-term basis.”

This is the mission set forth by Toyota Motor Corporation’s purchasing division. The “lowest possible cost” is not simply about being competitive, but rather establishing fair prices that facilitate stable long-term business relationships.

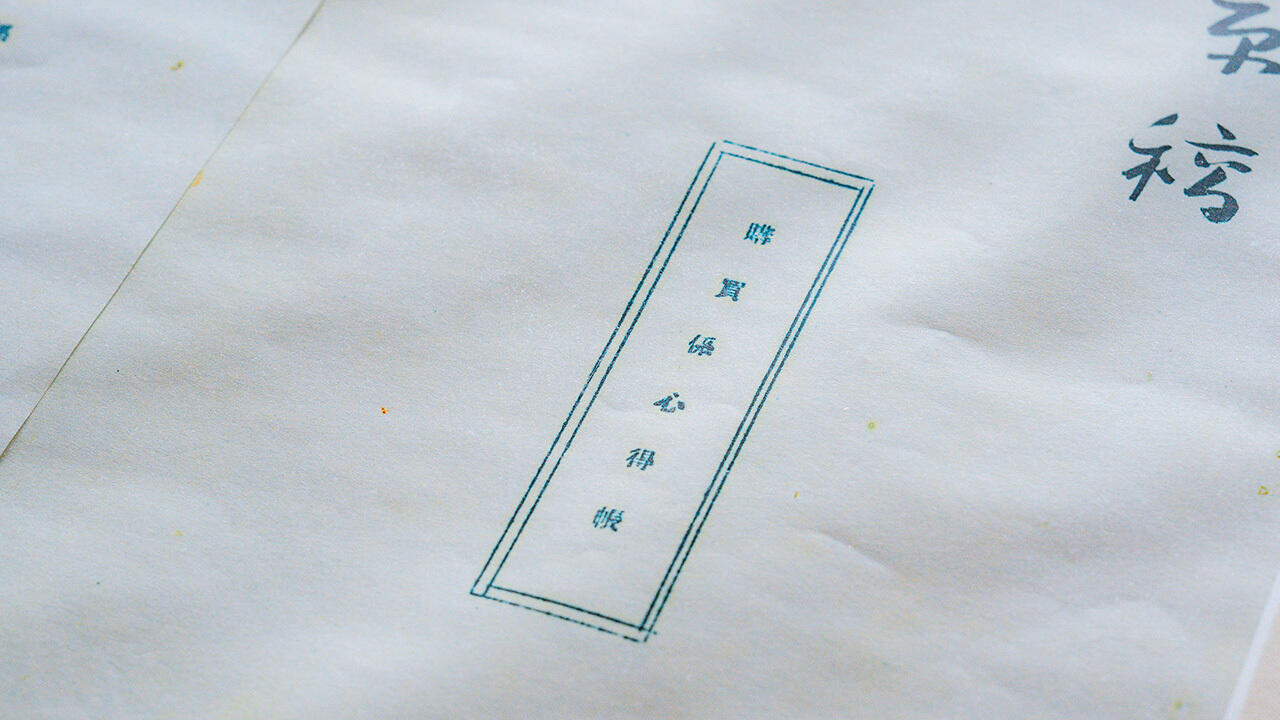

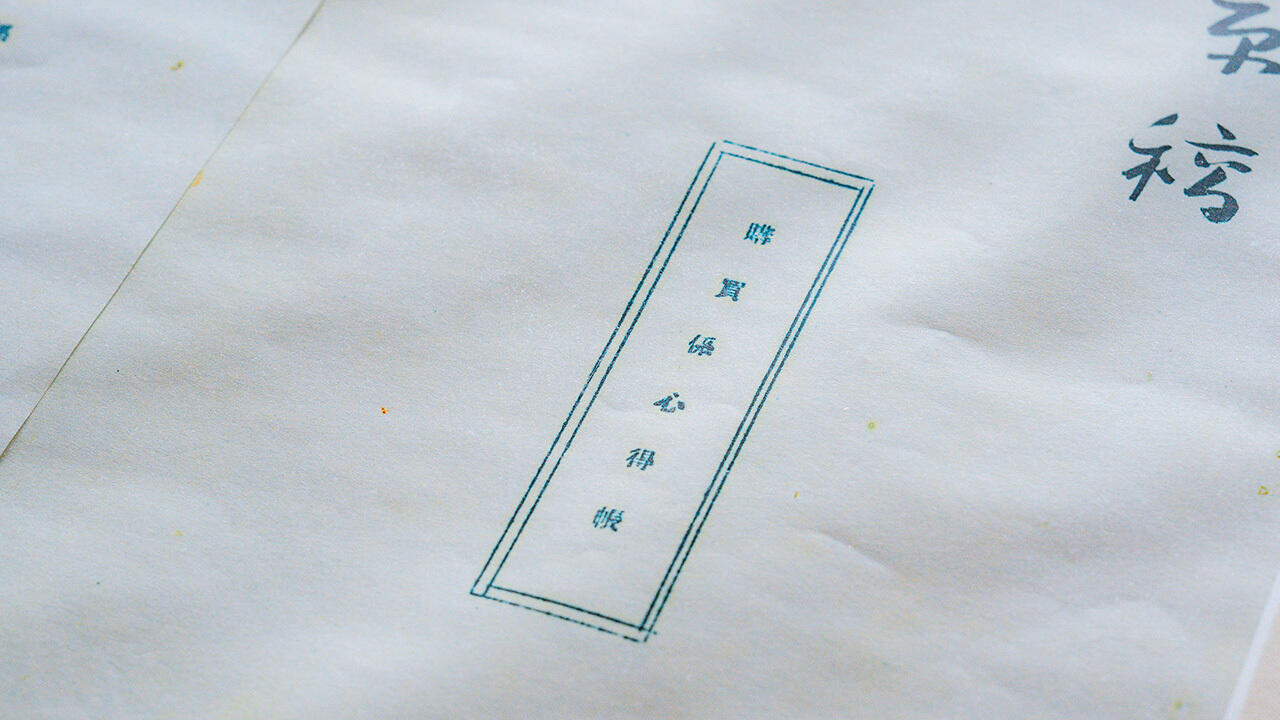

These guidelines stem from the Purchasing Staff Handbook, written by Kiichiro Toyoda. Instead of merely looking after its own interests, Toyota determines costs by working with suppliers, striving for mutual prosperity. This approach has remained unchanged since the company’s founding.

Nonetheless, as highlighted by the media, the auto industry has been criticized for violating regulations related to fair supplier transactions in recent years and for being slow to address the situation. Since 2016, the Japanese government has raised various issues, from pricing methods to fair standards for storage and disposal of part molds, and appealed to industry groups such as the Japan Automobile Manufacturers Association (JAMA) and the Japan Auto Parts Industries Association (JAPIA) to take action.

In a press conference in September, JAMA likewise emphasized the importance of ensuring fair practices across the supply chain.

Although the resolutions being implemented by the Small and Medium Enterprise Agency and JAMA align with the improvements that Toyota is undertaking with its suppliers, challenges remain.

Toyota is also working to promote fair trade practices. However, these efforts need to be strengthened, particularly in terms of reaching suppliers in Tier2 and beyond, with whom direct dialogue is not possible due to confidentiality and the Antimonopoly Act * . This issue was also raised at the expanded labor-management roundtable in July.

*The prices at which Tier2 sells to Tier1 are confidential information, and any act of intervention by carmakers is considered unfavorable to Tier1 suppliers (i.e., potential abuse of a superior bargaining position).

So, what kind of policies does Toyota adopt when engaging with suppliers? And how many companies does it deal with?

In this article, we take another look at Toyota’s relationship with its suppliers, including a discussion with Purchasing Group Chief Officer Kazunari Kumakura and Deputy Chief Officer Takami Kato.

A 60,000-strong supply chain

To grasp the current state of Toyota’s suppliers, let’s start by understanding the carmaker’s supply chain.

Since a single car is said to contain some 30,000 parts, naturally not all of them can be made in-house. Instead, the production process involves many different parts manufacturers.

Take, for instance, a single headlight. At Toyota, headlights are produced by Tier1 suppliers, with lenses manufactured by Tier2, which involves surface finishing by Tier3, using coatings made by Tier4... and so on. Components such as rubber covers and brackets must also be procured from Tier2 suppliers.

As the chart below shows, the supply chain’s tiers expand as we move outward from Toyota, the final assembler of vehicles. In Tier1 alone, Toyota buys parts from some 400 domestic companies; across the entire supply chain, the total reaches around 60,000, with annual orders worth approximately 7 trillion yen.

However, as we’ve already seen, Toyota can directly discuss transactions only with Tier1 firms. Negotiating directly with Tier2 suppliers may constitute an abuse of Toyota’s dominant position.

The Purchasing Staff Handbook

When it comes to purchasing parts from suppliers, prices are normally revised twice a year in April and October.

In these revisions, Toyota strives to ensure that prices are not raised by across-the-board rates which ignore suppliers’ costs.

Price revisions are based on the business conditions of individual companies. Productivity improvement plans are drawn up to maintain and boost competitiveness, while Toyota’s procurement staff help to strengthen systems and capabilities on the ground.

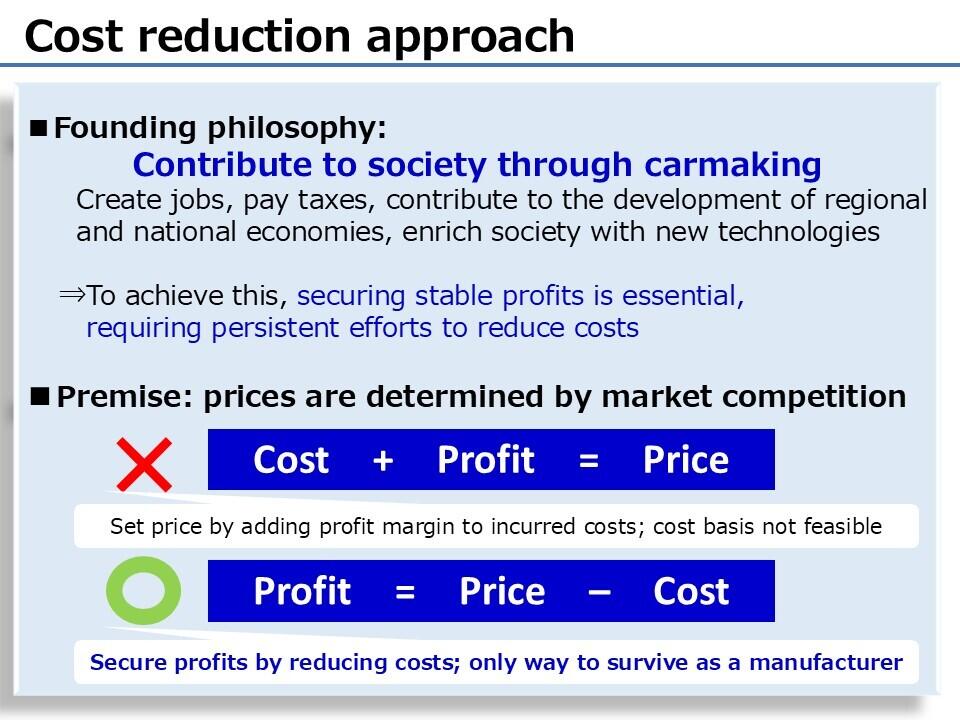

Since its founding, Toyota has followed a cost reduction principle that treats profit as a vehicle’s selling price minus its cost. Assuming that a car’s price is determined by the market, this approach focuses on securing profits by lowering costs.

This applies not only to the production genba, but every step in the monozukuri process.

At the heart of this approach lies the idea of co-prosperity with suppliers. The Purchasing Staff Handbook instructs staff to “make efforts to improve performance at supplier plants.” Maintaining and boosting supplier competitiveness is the basic premise of procurement at Toyota.

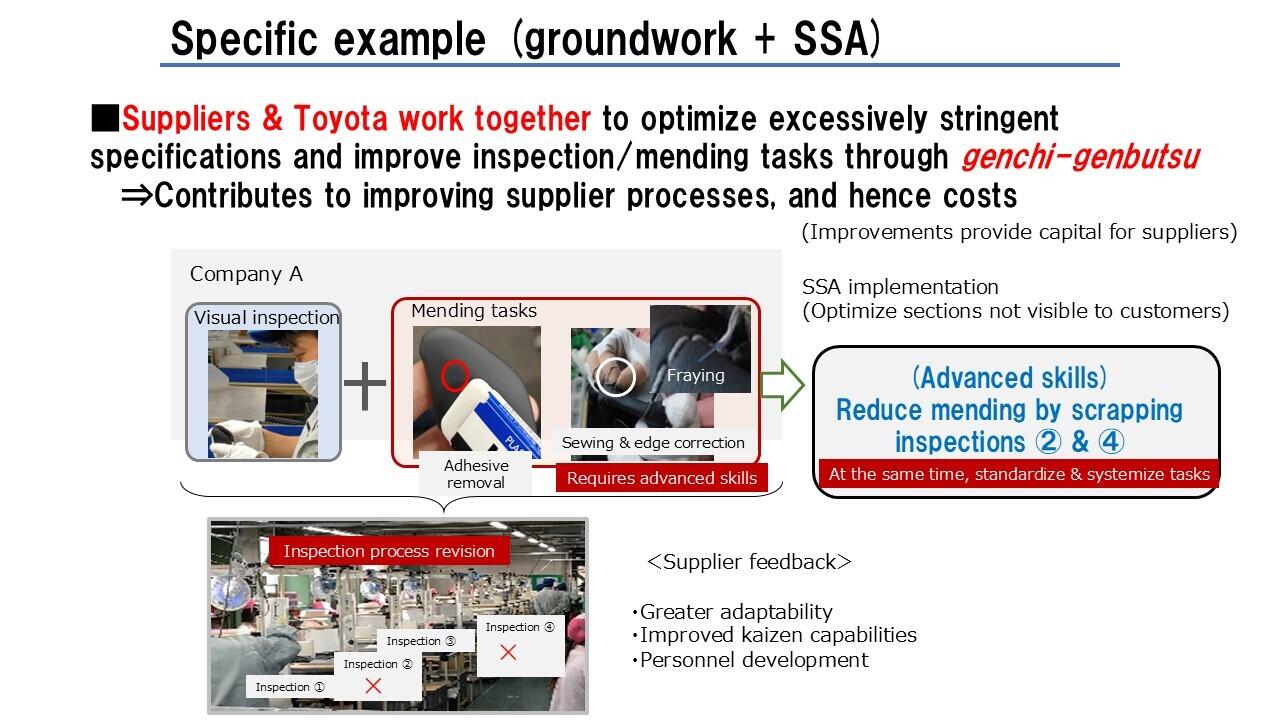

One part of these joint cost-cutting efforts with suppliers is Smart Standard Activity (SSA), which seeks to optimize quality and performance standards by identifying where components exceed or fall short of expectations.

For example, something like a small blemish on the underside of a seat is not visible to the customer who purchases the car and has no impact on the vehicle’s performance. Toyota’s staff review the inspection and repair processes for such areas to help improve supplier costs.

The purchasing team also works closely with suppliers to address other needs, such as using karakuri (simple mechanisms that make tasks easier) and devising better ways of storing spare parts.

When market prices fluctuate due to materials and other parts-related costs, these changes are reflected in prices according to rules agreed with suppliers.

The team also deals individually with cases where existing rules fall short, such as when new materials are required for decarbonization or surging materials prices need to be passed on immediately to avoid a major impact on suppliers.