Toyota has announced its financial results for the third quarter of the fiscal year ending March 2021. Just how has Toyota been combatting the impact of the COVID-19 pandemic? The answer is simpler than some people imagined.

Toyota Motor Corporation announced an operating income of 1.5 trillion yen from April to December 2020 at its FY2021 third-quarter financial results briefing on February 10.

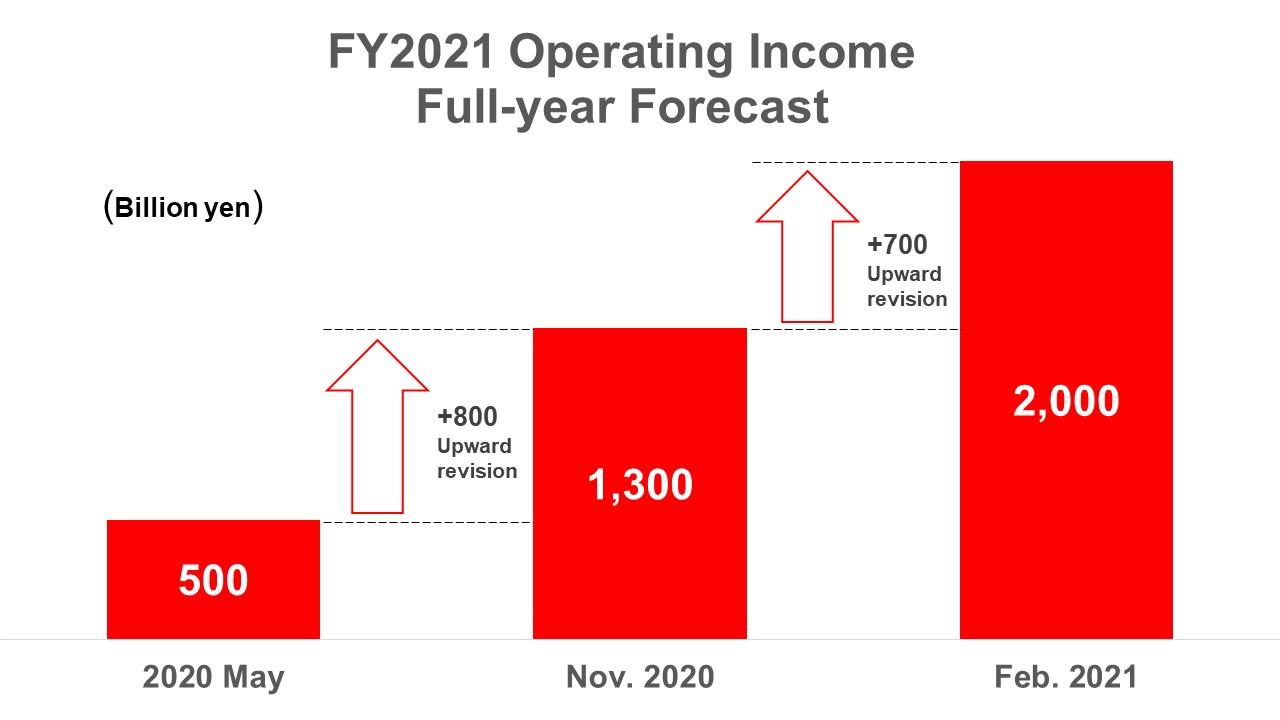

At the same time, Toyota revised its forecast for full-year operating income upward to 2 trillion yen (adding 700 billion yen to its full-year forecast issued when it announced its second-quarter financial results).

(Click here for financial result details.)

Presenting at the financial results briefing were Chief Financial Officer Kenta Kon and Chief Communication Officer Jun Nagata.

There was something that both operating officers repeated numerous times during the Q&A session with reporters after the financial results were explained. It was: “We did what we should do.”

Although the economy has been greatly impacted by COVID-19, Toyota’s operating income in the third quarter (from October to December 2020) was 987.9 billion yen, marking an earnings increase of 347.8 billion yen compared to the same period a year before.

Notwithstanding, even when asked during the Q&A about sales and cost improvement efforts, no secret weapon or anything special came to light. To the very end, the answer was: “We did what we should do.”

What was it that Toyota “should do”, even in the face of the COVID-19 pandemic? What has emerged as the key word is “communication”. Through the answers given by both Kon and Nagata during the Q&A, we will explain what this “communication” is all about.

The Efforts of 5.5 Million People

The word “communication” immediately appeared in the answer to the first question.

—How do you view this fiscal year and evaluate your cost-improvement efforts?

CFO Kon

For the full-year forecast, we are aiming for 185 billion yen in cost-improvement efforts. Every year, we (usually) aim for annual cost improvements of 300 billion yen. Excluding increases in the cost of materials due to market fluctuation, 185 billion yen, which is a gross figure, comes out to about a net 200 billion yen, so the amount is smaller than in usual fiscal years.

Volume is the main reason. On a full-fiscal year basis, we see a drop in new vehicle sales by a little more than a million units. Cost-improvement efforts, of course, have been made at suppliers and the front lines of our operations, but still, it's difficult to see the positive effects largely because of the volume decrease in the first half.

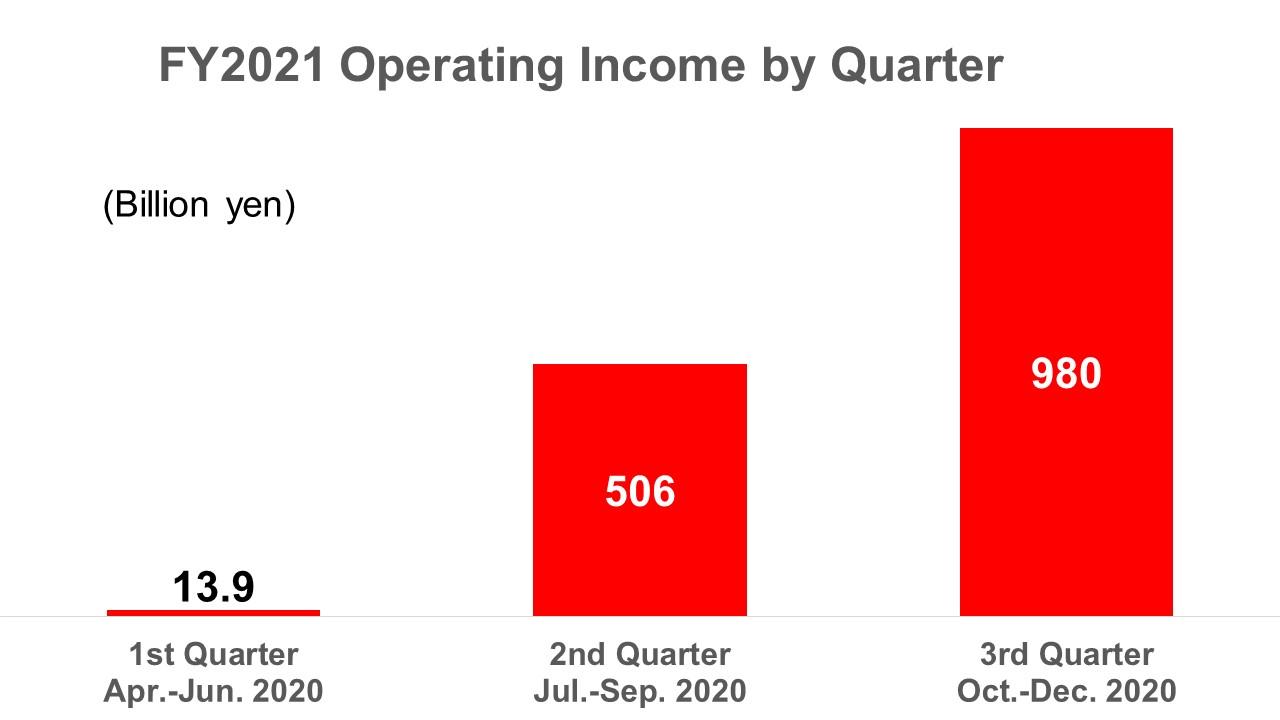

Overall, our evaluation at this third quarter is that we do see a recovering trend when we look at the numbers of each quarter; 13.9 billion yen in operating income in the first quarter, 506 billion yen in the second quarter, and 980 billion yen in the third quarter, respectively.

This is the fruit of all continuous efforts made together with our stakeholders, believing that we simply focus on doing what we should do, based on the guideline of 8 million units of vehicle sales and 500 billion yen in operating income that President Toyoda put forth at the beginning of this fiscal year.

When I had a discussion with President Toyoda about the financial results, he asked me to convey our gratitude to our stakeholders around the world and the 5.5 million people working in the automobile industry (in Japan) on his behalf.

Behind these results, there are strong efforts that have been made for a long time since the global financial crisis and made in the past year during when we reviewed and continued what we should be doing. We believe the results came about due to working diligently.

Communication That Changed Due to COVID-19

As already mentioned, our initial forecast for operating income announced in May last year was 500 billion yen. However, in our second-quarter financial results announced in November, our forecast was revised upward to 1.3 trillion yen, and this time it was further increased to 2 trillion yen.

Because the upward revision was so big, a reporter wanted to know about specific efforts Toyota was undertaking.

—Please elaborate on the specific factors behind your second upward revision this fiscal year.

CFO Kon

It’s difficult to explain briefly, and this was not something we have achieved just by ourselves. We strongly feel that this has been a collective effort by our dealers and suppliers, as well as all other people in the automotive industry such as logistics companies and people working at gasoline stations, who have committed to “driving economic recovery” as our industry’s mission.

We did things that we thought were the basics, things that we should do. We introduced 10 new models last year and nine this year as we had originally planned. That was easily said, but I think it required very hard effort to launch new models as scheduled. But we were able to make that a reality.

In Japan and other markets, when production was halted in the spring, plant members made efforts in kaizen activities to promote cost reduction at Toyota’s plants as well as suppliers’ plants. Some members worked on making masks and face shields.

As a result, we were able to continue our operation with large volumes while keeping our fixed costs lean when vehicle demand and production levels were recovering in the latter half of the year.

During these times, we took action to help society and the economy keep rolling. For example, we helped companies improve productivity in the production of medical protective gowns, and we are now trying to help with vaccine freezing storage processes and vaccinations.

In the United States and the United Kingdom where vaccinations have started, we are engaged in improving the overall process by using our Toyota Production System (TPS) know-how to reduce the lead time and long lines at vaccination venues.

With that said, Kon entrusted Nagata to supplement his answer with information on the sales side.

CCO Nagata

In spring when the pandemic started, we had no idea how much sales we could achieve under the situation. But President Toyoda set 500 billion yen in operating income and 8 million units in sales as guidelines.

In our Japan sales business, of which I am in charge, we created a guideline for each region and each dealership. We thoroughly followed up on the progress and the situation of sales and inventory levels every week, and we continuously revised the guidelines.

We focused on continuing these basic things.

Also, since the popularity of each model is different, some of the vehicles made in certain plants were not as popular as others in terms of volume. So we had to close the gap in operation levels among our plants. We frequently planned campaigns and measures to boost our sales.

In the meantime, one thing that was pushed forward globally was online sales. We have considered and tried new ways to reach customers and take orders in a contactless form and provide customers with affordable services using our financial products.

And our dealers around the world have made efforts to serve customers more thoughtfully, such as providing disinfection services to customers who came for maintenance so that they could drive their vehicles with peace of mind.

During this with-COVID period, I think we were able to take actions little by little after sincerely thinking about what customers want and what they are worried about.

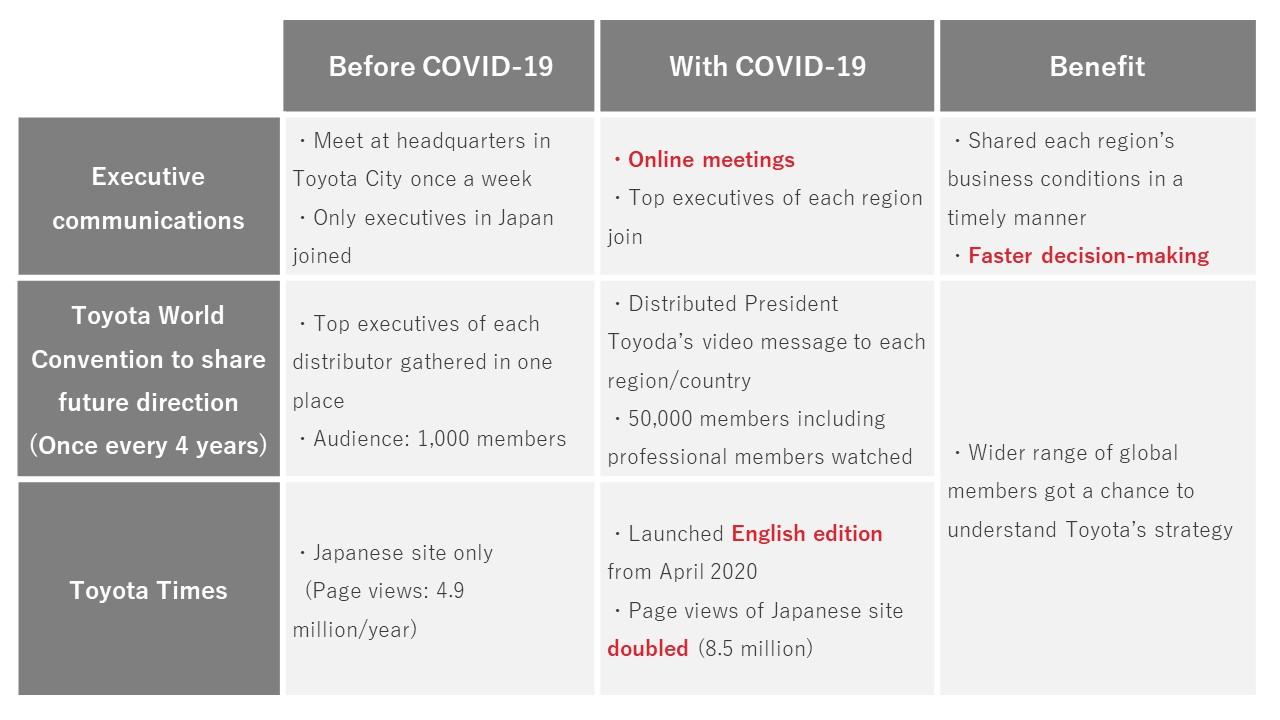

If I add a little more to the efforts of employees and stakeholders, I think that the change in communication was the biggest factor that contributed to pushing people forward.

Specifically, President Toyoda, who is of course our top executive, has changed how he communicates with employees and all other stakeholders, taking the advantage of online communications and tools that have become common.

After that, Nagata gave an example of how communication drastically changed due to COVID-19. He explained that the change brought employees and other stakeholders around the world together.

For example, once every four years, Toyota invites overseas distributors and top executives of major subsidiaries to its Toyota World Convention, which Toyota has used to explain its mid-term strategy.

Until now, only about 1,000 people could participate due to the capacity of the venue, but by recording and distributing Akio’s presentation video, 50,000 people including general employees could watch it.

According to Nagata, “Each employee was able to understand how Toyota will change going forward,” meaning that they were able to reaffirm the importance of working hard at their immediate tasks.

He said: “I think it was a factor that enabled people to calmly engage in their work at hand”, despite having concerns about not being able to see the future during the COVID-19 pandemic.

Furthermore, the idea of sending messages to the 5.5 million people working in the automobile industry came into being at the beginning of the year because remote communication had become possible.

Now, more and more issues need to be overcome not only by Toyota but also by the industry as a whole, such as the realization of carbon neutrality in 2050. Communication that brings people together for tackling such issues has become possible.

Relationship with Suppliers Dealing with a Semiconductor Shortage

The global semiconductor shortage is impacting industry. With demand for PCs and game consoles rapidly increasing as people are staying home, there are concerns that such demand will put pressure on in-vehicle products, and there are reports that some semiconductor manufacturers are considering raising prices.

Even so, Toyota plans to increase its full-year global sales volume (Toyota-brand and Lexus-brand retail sales) by 300,000 units from the 8.6 million units stated during its second-quarter financial results announcement in November. A reporter asked a question about the impact on Toyota from heightened semiconductor demand.

—Why is the impact on Toyota limited while other companies are greatly affected by the shortage of semiconductors?

CFO Kon

First of all, regarding semiconductors, there is a tight demand/supply situation globally and we are in the same situation. However, we do not see a significant decrease in our production volume for the near term.

We do see risks. That is why we continue to communicate with suppliers and monitor the situation, every day, every week, and every month, and not just with Tier 1 suppliers, but also with semiconductor makers.

Regarding the outlook, we hear some views that the shortage may continue until summer, but I don’t think it will be that long in our case, based on the information I have learned from our purchasing divisions and suppliers.

Learning from lessons when our supply chain was destroyed in a past crisis (in the Great East Japan Earthquake in 2011), we have looked into multiple tiers of our suppliers and tried to create a system that enables us to find out which suppliers and what parts are at risk in the early stage of a crisis.

When we confirm situations with suppliers, we provide suppliers with a sure and reliable production plan for the following several months and sometimes a three-year forecast.

We have communicated with suppliers based on such trust and reliable information for a long time, so I think that is one factor.

Secondly, as part of our business continuity plan, or BCP, we had secured one to four months of inventory for semiconductors.

And thirdly, we have made sure to communicate and align closely with suppliers, not just Tier 1 suppliers but also Tier 2 suppliers and so forth.

I heard from our Purchasing Group that it has been communicating with suppliers via teleconference as many as 10 times a day when the parts supply situation is severely tight.

I think that our policy of placing orders with reliable figures has become the basis of our close relationship with suppliers in difficult situations.

Additionally, a reporter asked a question about changes in Toyota’s relationships with suppliers during the COVID-19 pandemic. Starting with “I wonder if it’s alright for me to say this”, Kon touched on quite specific exchanges in Toyota’s communication with suppliers.

—With the impact of COVID-19, it was quite a different year. How have your relationships with suppliers changed?

CFO Kon

Relationships with our suppliers were mainly with Tier 1 suppliers. Regarding suppliers further beyond Tier 1, we relied on the Tier 1 suppliers to take responsibility.

However, this year, many suppliers have been struggling. Production volume rapidly dropped but also shot up to a very high level due to demand recovery. So, through our Tier 1 suppliers, we worked with more than 10,000 Tier 2 suppliers to confirm their business and profit status.

This is a completely new kind of relationship with suppliers.

Also, to most suppliers, we had an excessively high level of quality standards. Even if we did not request so directly, suppliers would deliver perfect products only by leaving out products with a very tiny scratch, for example, thinking that Toyota wouldn’t accept them.

So our engineers visited the supplier worksites to discuss with suppliers so that both sides could confirm and agree on the acceptable level of quality.

Previously, to suppliers, I think Toyota members were rather invisible and people to be afraid of. But engaging with them face-to-face changed that perception, and I think that it contributed to accelerating cost-reduction efforts conducted together with suppliers.

The 2011 Great East Japan Earthquake brought plants and production to a halt. It took more than a month for Toyota to restart.

The results of improving procurement networks based on lessons learned at that time have come to manifest in the COVID-19 crisis 10 years later.

Toyota’s latest financial results show that Toyota’s various functions such as production, sales, and procurement, and its stakeholders have valued close communication since normal times.

And that stance is accelerating rather than fading in the time of COVID-19. And Toyota, armed with the relationships of trust that it has built over time, can be seen confronting this crisis head-on.

Perhaps in words, the way to say it is “doing what we should do”. The latest financial results became an occasion to reaffirm the difficulty of such and the magnitude of its value.