Despite revising upward its year-end forecast for operating income, Toyota still has a stern outlook. Through the answers to reporters' questions at Toyota's financial results announcement, Toyota Times takes a closer look at how the company views the situation.

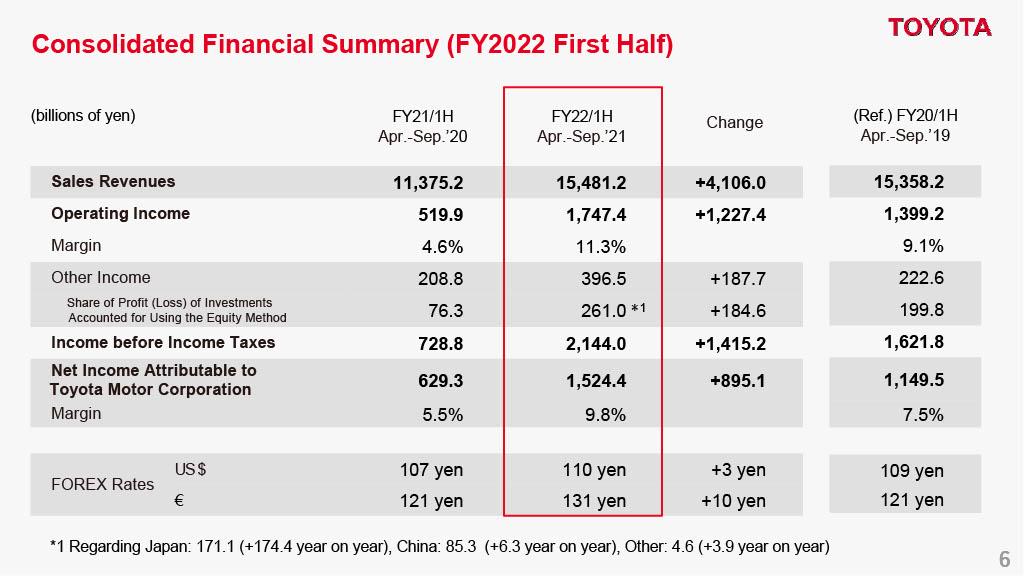

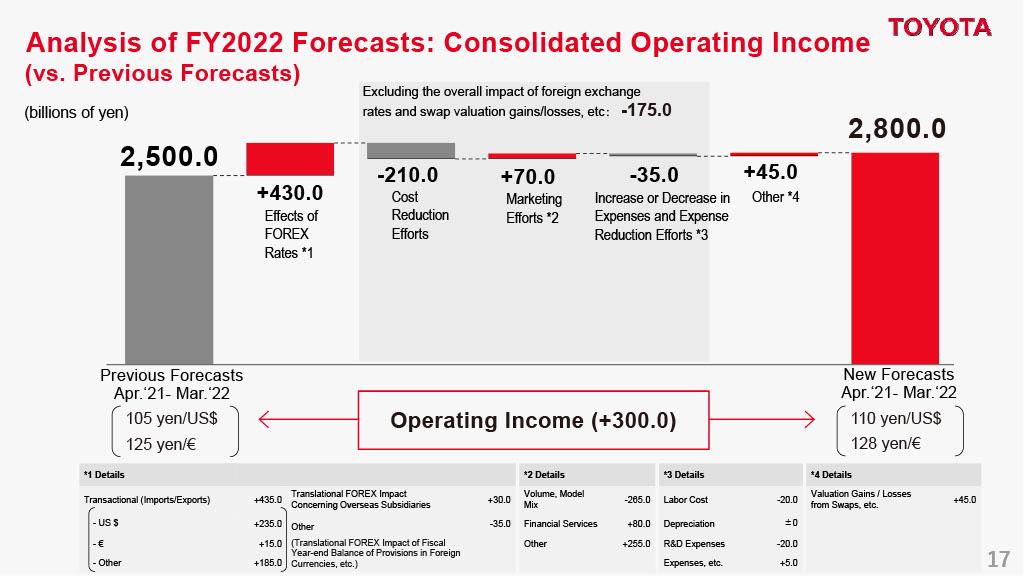

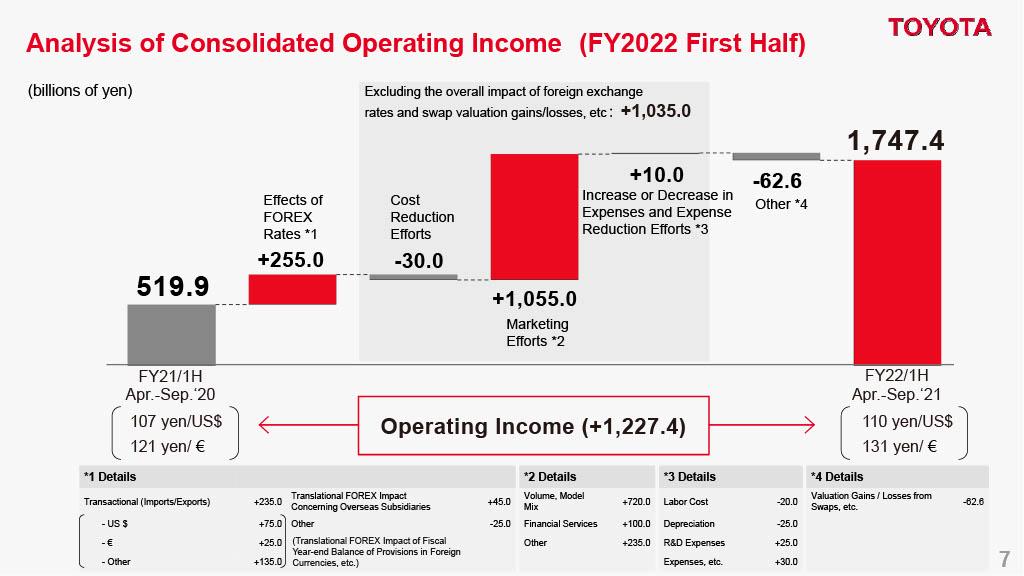

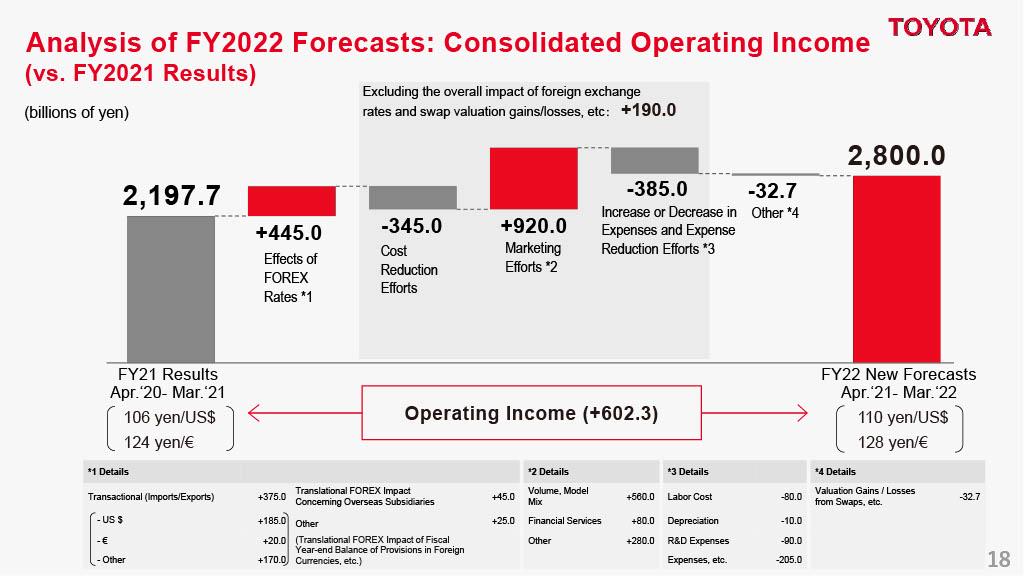

On November 4, Toyota announced its second-quarter financial results for its fiscal year ending March 31, 2022. Sales revenue and operating income marked first-half record highs, and Toyota revised upward its forecast for full-year operating income from 2.5 trillion yen to 2.8 trillion yen.

Despite the outwardly positive results, Chief Financial Officer (CFO) Kenta Kon, who joined the press briefing for announcing the results, presented a stern outlook. He explained that factors beyond Toyota's capabilities contributed to such favorable results, as well as did a weak yen, without which Toyota’s upward revision to its full-year forecast would be a downward one in real terms.

This article takes a closer look at how Toyota evaluates these financial results through the exchanges between reporters and CFO Kon, as well as Chief Communications Officer (CCO) Jun Nagata, who was also on hand at the press briefing.

Question 1: First-half review and production recovery measures

After having announced a production forecast of 9.3 million (for Toyota and Lexus vehicles) in May, Toyota has revised its production plan several times since August.

This was due to the shutdown of plants and suppliers in Southeast Asia due to COVID-19, as well as the impact of chip shortages, which led to a downward revision of production by 300,000 units to 9 million units announced in September. As a result, the forecast for sales was lowered by 200,000 units to 9.4 million units.

Even though Toyota could not make cars as it liked and its customers were forced to wait, the company recorded all-time first-half highs. The first question sought Toyota’s evaluation of its financial results in light of this situation.

--How do you evaluate and sum up your first half? How do you envision recovering production going forward?

CFO Kon

While production was stagnant around the world in the first half of the year, a shared desire by our dealers, suppliers, and plants the world over to deliver as many cars as possible to waiting customers (as quickly as possible) allowed us to keep production restraints in check.

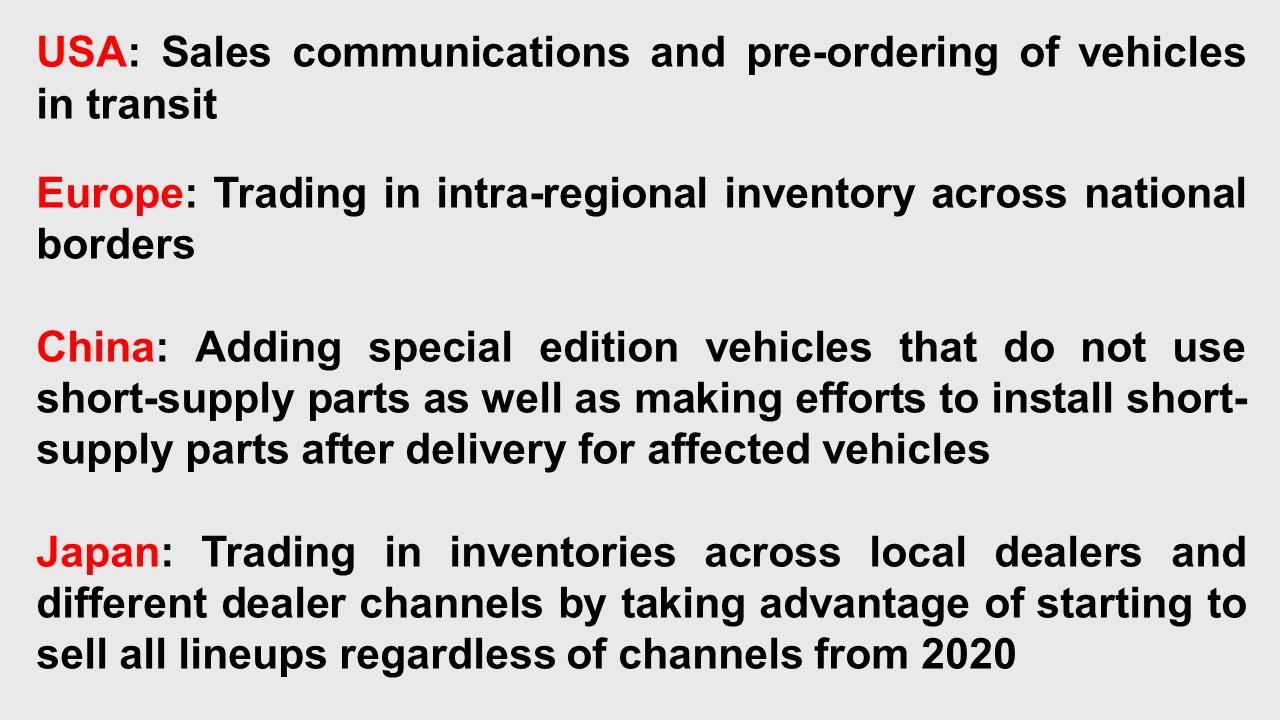

A big factor in sales not dropping as much as production during this production squeeze and significantly increasing compared to last year is that dealers were able to deliver cars based on firmly grasping sales opportunities that came with tight inventories, as well as with being flexible and efficient, and communicating with their customers.

On the other hand, factors beyond our capabilities, or a tailwind, also played a part. While the new car market is tight all over the world, used car prices have significantly increased, and the residual value of leases in the finance business has taken a turn for the better. Also, sales incentives have been kept very low.

However, the soaring cost of materials has had a huge impact that can’t simply be passed on to our customers. So, we have to compensate by working hard to improve costs, reduce fixed costs, and increase the vehicle value.

Our entire company is working hard to improve costs and reduce fixed costs. So far, we don’t sense a rebound to the pre-COVID19 situation.

On the sales side, I think sales did not drop because of our foundation of strengthened products. I would say that President Akio Toyoda’s long-continued efforts, such as an emphasis on making ever-better cars, TNGA, strengthening product competitiveness and lineups, and arranging vehicle models in groups (variant body types based on one model and platform), have started to be very effective.

There is still some risk regarding the recovery of production. The production volume of 9 million units announced today is somewhat conservative as there is some risk even after December.

Because we are keeping our customers waiting, our current plan is premised on doing everything that we can, including operating production lines on Saturdays.

Question 2: Toyota’s stance on distribution to suppliers

The second question was asked with the Japanese government’s “virtuous cycle of growth and distribution” in mind.

In the automotive industry, like in other industries, smaller suppliers are struggling to cope with carbon neutrality initiatives and CASE. Against such a backdrop, a reporter sought Toyota’s thoughts on distribution.

To respond, CFO Kon drew on his experiences of personally visiting suppliers and hearing what they had to say.

--With some of your suppliers having a hard time when it comes to earning profits, how do you view your latest results? What are your thoughts on distribution and returns?

CFO Kon

Our relationship with our suppliers has always been based on the concept of “co-existence and co-prosperity”, in which we work together to improve costs, increase the competitiveness of our suppliers, and share the benefits of these efforts fairly and equally with our customers.

I, myself, talked with our suppliers this time. Even though Toyota has made several announcements about production cuts, they told me that Toyota’s orders are very accurate and that they are informed very quickly and in detail whenever production cuts occur.

Reduced production means reduced parts, which of course impacts suppliers. But suppliers have said that they have never experienced losses due to being over-ready to supply us.

We are also promoting our SSA (Smart Standard Activity) initiative, which is aimed at addressing suppliers’ problems and in which we work with our suppliers to lower costs while optimizing the required level of quality. There are thousands of ideas and suggestions so far.

For example, in response to a casual comment from a Toyota representative about not wanting a line that marked an assembly point to disappear and be very clear on a particular part, the supplier used a highly permanent ink. But that ink was very expensive, so Toyota engineers went to see the situation and found that using a basic permanent marker would be good enough.

Activities to improve the problems of suppliers based on this kind of communication have become quite common.

But receiving comments that point out things like you just did means that we are still lacking and have a long way to go. We will strive to continue to sincerely pause and improve, and we look forward to your continued guidance.

The “Co-existence and Co-prosperity” procurement policy that Kon mentioned has its roots in the purchasing regulations written by Toyota founder Kiichiro Toyoda. Those regulations state: “Our suppliers are like branch plants for which we must strive to improve performance.”

Rather than simply trying to get something for a low price, Toyota takes it upon itself to apply its know-how and work with its suppliers to raise their productivity. This is the basic spirit of procurement at Toyota.

Furthermore, Toyota’s approach to cost improvement, which has remained unchanged since its founding, is that “profit equals price minus cost”.

Rather than the “cost plus profit equals price” approach, in which the price is determined by adding profit to the cost, Toyota’s approach is premised on the principle that prices are determined first through market competition, while profits are secured through cost improvements.

For this, efforts to control costs are made, but they are not limited to production sites. They cover all manufacturing processes, including design and procurement at suppliers, to correct excessive quality and optimize the required specifications.

And if Toyota causes any impediments to cost improvement, they, too, are reviewed.

Japan’s automobile industry is said to be like a pyramid with finished car manufacturers at the top. And some people have an image of the industry unfairly demanding price cuts from the top to the bottom.

However, Toyota is working together with its suppliers to improve costs and aims to strengthen its competitiveness by sharing the cost benefits it achieves.

Additionally, when wanting to revise prices, Toyota does not propose a uniform revision rate that covers all of its suppliers. Rather, it considers the competitiveness and financial condition of each company and carefully moves forward from there.

Rather than seek discounts without regard to costs, Toyota focuses on building win-win relationships.

Question 3: The effect of cost improvement and the strengthening of a profit structure

Improving costs on the scale of 300 billion yen a year is said to be Toyota’s specialty. However, the results for the first half of this year show that Toyota’s cost improvements were down by 30 billion yen compared to last year.

Although this was because the total includes a rise in prices of materials such as steel, aluminum, copper, and precious metals used in catalysts, a reporter asked about the actual effect of cost improvements that are not visible in the data and how Toyota handles situations that could negate them.

--What is the breakdown of the 30 billion yen drop in cost improvement efforts? Is there any room for further strengthening your profit structure?

CFO Kon

For gross cost improvement excluding market conditions, we target an annual improvement of about 300 billion yen. That means we had to reduce costs by 150 billion yen for each half, but we came up a bit short (in the first half). Said another way, market fluctuations accounted for the rest.

For the second half of this fiscal year, the impact (of the market) is on the way to being slightly greater, so we envision our full-year net cost improvement effect will be down by 345 billion yen compared to the previous year.

Out latest gross annual cost improvement forecast is slightly below the target of 300 billion yen. Pure cost improvement is greater than 200 billion yen, but the rest (which makes the net results a decrease of 345 billion yen) is due to market conditions. Subtracting the first half results shows that the situation in the second half is even more difficult.

As for specific initiatives to strengthen earnings, we want to make this figure (for cost improvement efforts) as positive as possible without the influence of foreign exchange rates in the short term.

That said, we don’t have any items that can be improved by 100 billion yen at one go, so, in the second half, we will continue to do what we have been doing for a long time—accumulating thousands of yen or just a few yen when it comes to parts and thousands or tens of thousands of yen in the case of fixed costs.

And then there is the value chain. We will further improve profitability in areas other than new car revenue, such as supply parts, accessories, used cars, connected business, and software.

By doing so, we will strive to exceed (our operating income forecast of) 2.8 trillion yen, even if only by a little.

Question 4: Toyota’s response to vehicle electrification

For carbon neutrality in 2050, moves toward vehicle electrification are accelerating in the automobile industry. In September, Toyota held a press briefing on battery development, and, in October, it announced its plan to build a battery production plant in the United States.

Toyota plans to expand its current global lineup of 55 electrified vehicles (consisting of hybrid electric vehicles [HEVs], plug-in hybrid electric vehicles [PHEVs], fuel cell electric vehicles [FCEVs], and battery electric vehicles [BEVs]) to approximately 70 models by 2025.

Of those, 15 models will be BEVs, and Toyota has an electrified vehicle sales plan that includes selling 2 million zero emission vehicles (ZEVs), namely BEVs and FCEVs, a year globally by 2030. Its plan in the U.S. is to sell 1.5 million to 1.8 million electrified vehicles including ZEV models a year by 2030.

A question was asked about Toyota’s response to electrification, which is being pursued amid increasing investment in the future. CCO Nagata answered.

-- How will Toyota respond to electrification?

COO Nagata

I think it’s basically about how we can reduce CO2 emissions from the ground up. What we have been saying for quite some time is that we are an “electrified vehicles department store”. In other words, we will offer a full lineup of electrified vehicles for customers in various countries and regions to choose from.

Because energy and fuel supply situations are completely different depending on the region, our plan has long been to promote battery electric vehicles (BEVs) in Europe, which has plentiful renewable energy, and promote different options elsewhere where conditions are not the same.

If the volume of renewable energy increases and costs go down, I believe for sure that BEVs will become a mainstream electrified vehicle option.

About two months ago, we announced that we will invest 1.5 trillion yen in batteries, which will serve as the base for BEVs. We also announced that we would spearhead that by building a battery plant in the U.S. by 2030 at a cost of about 380 billion yen. And we said that we will have a BEV lineup of 15 models by 2025.

And we have already revealed our BEV-dedicated bZ4X. We are not losing out to other OEMs when it comes to batteries and BEVs. We want to ready a selection of products that are sure to be winners.

BEVs are very effective given that clean energy is available. But, as we have explained so far, with the current energy situation in Japan, PHEVs will probably be better at reducing CO2 emissions, and HEVs are more affordable and have the potential to significantly reduce CO2 emissions.

And there’s another thing. To provide a full lineup of electric vehicles, we have reiterated our intention to promote technological innovation so that the 5.5 million jobs in the automotive industry in Japan are protected.

However, to our great regret, people say that Toyota is advocating HEVs only for the sake of doing so and is against BEVs. That’s not the case at all.

It is sometimes difficult to gain understandings of what we are conveying. And seeing that we are failing there is sometimes painful. We will continue to think about how we can get across our message that we, too, take BEVs seriously.

Together with stakeholders

Toyota has broken free of the temporary yet serious crisis over production cuts and seems to be heading toward normality. But, because it still faces issues related to soaring material prices and parts supply, the company’s outlook for the future remains stern.

Amid its current predicaments, Toyota has only been able to revise its full-year profit forecast upward thanks to the efforts made in cooperation with its suppliers and dealers.

Akio, who also serves as the chairman of the Japan Automobile Manufacturers Association, has said on various occasions that the automotive industry significantly impacts the Japanese economy, employing 5.5 million people, which is roughly 10 percent of all people employed in Japan, generating approximately 15 trillion yen in annual taxes, and having an economic ripple effect that is 2.5 times greater than its output alone.

Japan’s automotive industry has a strong sense of responsibility as a key industry in that revitalization or stagnation of the Japanese economy depends on its efforts.

The industry aims to develop sustainably with all stakeholders, including suppliers, dealers, and other colleagues among its 5.5 million people, as well as with local communities.

For its customers and stakeholders, Toyota will continue to make every effort to deliver as many cars as possible, as quickly as possible.