This is the second article in a three-part series covering Akio's responses during the Q&A session at Toyota's 1H financial results briefing. In this article, the focus is on Toyota's vehicle electrification strategy.

On November 6, Toyota held its interim financial results briefing where it disclosed its earnings and where Akio shared his remarks that revealed his thinking on the “Toyota Philosophy” and answered questions on other topics of interest, such as Toyota’s business strategies, from those in attendance.

Among the questions asked, one was about Toyota’s vehicle electrification strategy.

Electrified vehicles are automobiles that use electricity as part of or as their main source of propulsion and includes various types of models, such as hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV), battery electric vehicles (BEV), and fuel cell electric vehicles (FCEV).

“Which type of electrified vehicle will be the winner for the next generation of automobiles?”

Either way, they are trying to predict the future of automobile manufacturers and the automotive industry, and vehicle electrification is obviously a theme that is demanding a lot of attention.

In those circumstances, Tesla’s advances, without regard to this shroud of COVID-19, are a topic of high interest to journalists. The next question at the briefing was based on that point of view.

Question:

You’ve seen the bullish performance by Tesla [in terms of market valuation]. They are switching to insource batteries for their vehicles, accelerating their cost competitiveness. How do you view their activities and Tesla? Based on what they are doing, can you please explain about Toyota’s electrified vehicle strategy?

First, Akio addressed the question about Tesla.

Akio Toyoda

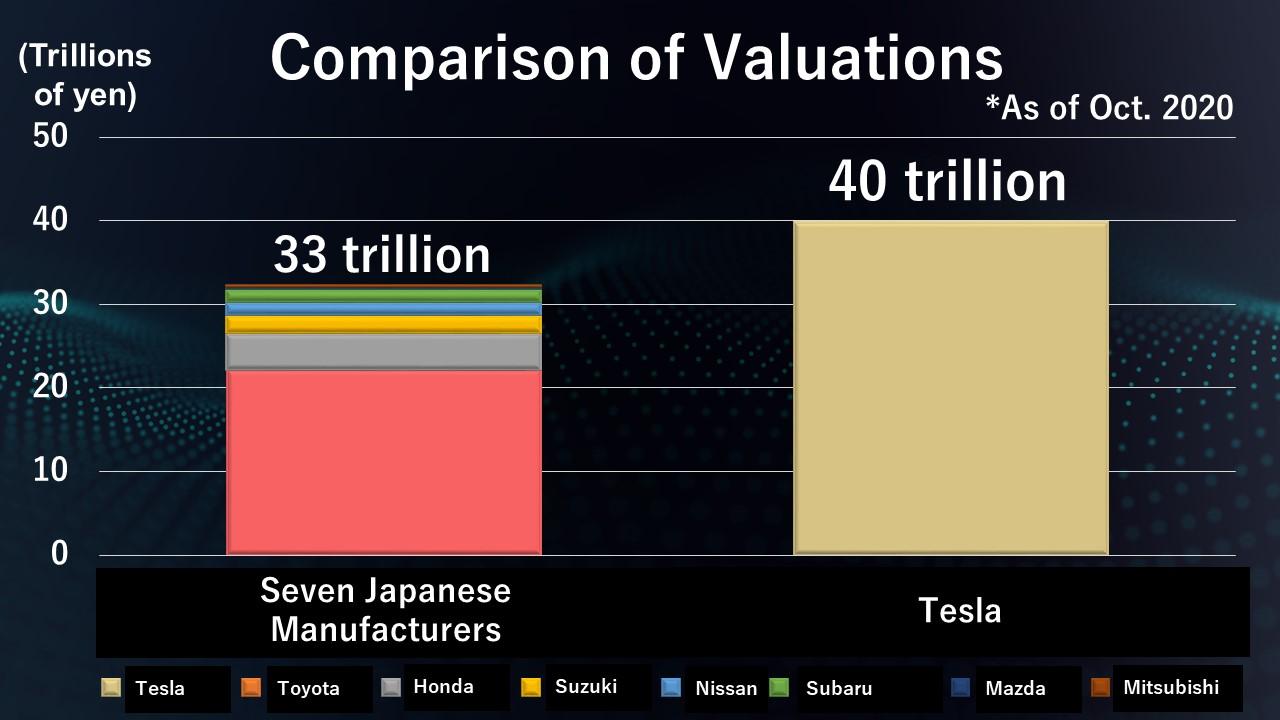

First of all, on the stock market valuations, Tesla’s market capitalization is around JPY40 trillion.

The combined value of all seven Japanese automakers is about JPY33 trillion, so the single company, Tesla, is perceived as delivering larger corporate value than all of the Japanese automakers.

Tesla makes profit from Battery Electric Vehicles (BEV). Also, they have a business model where they also generate profit from software updates.

Akio, not only looking at the valuation as an expectation from Tesla in the future, openly admitted that the overall business model and actions for the environment are things that Toyota could learn from.

A lot of automakers are selling hardware, or new vehicles, which is where the majority of their profit is generated. After a vehicle is purchased and handed off to a customer, it is common sense that the value of that car would go down over time.

However, Tesla’s business model is such that even after the hardware (vehicle) is sold, as the customer owns it, through software updates directly to the car, they are able to continue to add new value, resulting in increased profits.

Understanding this, Akio continued on in his response, explaining Toyota’s efforts.

Akio

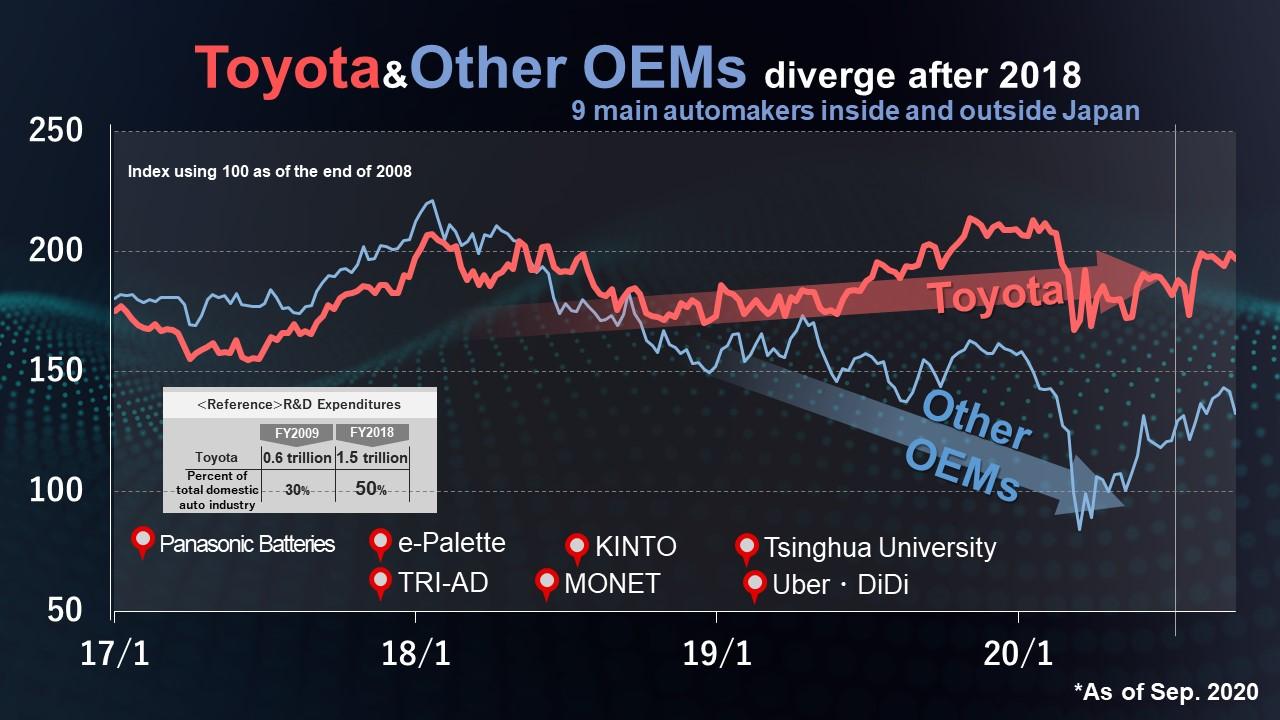

However, Toyota has also been busy over these past three years making future investments in the area of C.A.S.E. (hereinafter "CASE") I think it is strikingly obvious if you look at the stock market trends in 2019 that Toyota’s price has started to diverge, moving in a little bit different [upward] direction from the general automotive segment.

In addition, we have established Toyota Research Institute Advanced Development (TRI-AD). Based on our new efforts with software called “Arene” at TRI-AD, we are already proceeding to take a “software-first” approach to vehicle development.

Indeed, when taking a look at Toyota’s press releases over recent years, it is clear that the company has made a definitive effort in the area of CASE.

At this point in his response, Akio turns to an analogy to try to help explain his analysis of the differences between Tesla and Toyota, by making a comparison of the two using a restaurant.

Akio

What I think [Toyota has that] Tesla does not have is over 100 million vehicles in operation in the real world.

To draw a comparison about what I mean when I say “real” in terms of operation and business, I’d like to use an analogy of a kitchen and a chef. To me, Tesla’s business [might be viewed as a business] where there still is no chef or kitchen, but they have a recipe they are trading. The company sees its recipe as “becoming the world’s standard for cooking.”

Just as there are differences for each customer’s preferences, the energy conditions in each area of the world differ, and so by having a menu with different vehicle electrification options, we believe we have a better chance at being chosen by the customer.

As for the current share price, we are certainly losing [against Tesla]; however, we are not watching from the sidelines, but surely taking the measures we can.

I do believe that we may be one step ahead in that we have a full line-up of electrified vehicles already being offered in the real world.

Following Akio’s response, the head of Toyota’s vehicle electrification strategy and Chief Competitive Officer, Shigeki Terashi, took some time to explain his thoughts on what comprises the core of vehicle electrification.

CCO Shigeki Terashi

The other day, Prime Minister Suga announced the targets for a carbon neutral Japan by 2050. I don’t think this can be accomplished in 2050 unless the mobility society is one with vehicles with zero emissions.

Under these conditions, we will see stricter environmental regulations coming into effect around the world. Attempting to achieve these goals as we turn towards 2050, it will be necessary to develop a variety of technologies.

For example, areas where there is hydrogen available would be able to use that hydrogen for fuel cells, while places with a lot of renewable energy or the like may be able to use that for battery electric vehicles, or it could also be used to produce hydrogen. I believe that there are a lot of choices that can be made.

At any rate, we do not think that only pursuing one option is the best way. As such, we feel customers will choose mobility based on the surrounding conditions, level of regulations, and other customer or regional preferences.

At the time they go to choose, Toyota will be there to provide a vehicle that will allow them to make that choice, whatever suits their daily life and activities.

And, as President Toyoda shared, we believe it is the customer who ultimately will choose the type of mobility. Based on what the customer chooses, regardless of regulation, our goal is to still reach the point of being carbon neutral.

By working to accomplish these two objectives simultaneously, it will be necessary for us to brush up or enhance our technologies.

By having multiple options, the allocation will gradually change as the years go by, with the end result of us achieving a world with zero emissions. As that happens, we are deeply considering what we can do for the changing environment.

When asked about the most likely candidate for the next-generation electrified vehicle, Akio always uses phrases like “it is the market and customer that makes the choice.”

BEVs are not the only electrified vehicle that can be chosen. Starting from the way a customer uses their automobile to considering the infrastructure, sources of energy, and the types of government-related policy in the respective area, the solution may be different.

Being a full line-up manufacturer that is able to meet the demands of any given type of electrified vehicle means that more customer voices will be able to be served.

To the extent that automakers try to decide for force what the next generation electrified vehicle will be, they will find the hardness of the markets and the customers. That way of thinking may be rooted in Toyota’s electrified vehicles strategy.

In the next and final article in this three-part series, the topic will focus in on Woven City, the prototype city of the future announced by Akio at the start of the year. He provided an update at the Q&A session on when construction is slated to begin on the new city and other general progress.